Market for milk and dairy products

Russian State Trade and Economic University

Faculty:

Commerce and Marketing

Speciality:

Marketing

abstract

By discipline Food markets

Topic: "State and prospects for the development of the milk and dairy products market»

The work was done by a student

The work was accepted by professor

Romanyuk Galina Grigorievna

Moscow 2009

Market trends and volumes

Import and export of dairy products

Consumption of dairy products

Market Development Forecasts

Bibliography

MARKET DEVELOPMENT TRENDS AND ITS VOLUME

Dairy market can be divided into the following segments: milk, kefir, sour cream, cream, fermented milk products (ryazhenka, curdled milk, varenets), yoghurts, enriched bio-products (bio-kefir, bio-yogurt), cottage cheese, desserts, butter. According to the Dairy Union of Russia, for the entire range of dairy products, with the exception of butter and classic cottage cheese, there is a steady growth in the total volumes of both production and consumption.

The Russian market of dairy products is constantly growing, and competition is intensifying. This is due both to the gradual increase in the well-being of the majority of the country's population, and the constant increase in production volumes by market players, as well as the emergence of foreign manufacturers in Russia. The market for dairy products is quite well studied, but not all information is open. Most of the published information contains data only on the largest market players, while in many cases it is necessary to have facts that illustrate the full picture.

The main factor hindering the development of the production of milk and dairy products is the state of Russian animal husbandry. In recent years, there has been a constant reduction in the major cattle(Table 1).

Table 1. Dynamics of change in the number of livestock in Russian Federation(as of January 1; in farms of all categories; million heads) *

|

Cattle |

including cows |

|

* Source: Rosstat, http://www.gks.ru/free_doc/2007/b07_11/15-20.htm

However, according to Rosstat, in January-March 2007, milk processing enterprises produced more dairy products than the corresponding period last year, except for canned milk. The production of butter and cheese increased especially significantly (Table 2).

Table 2. Production of dairy products in the Russian Federation (in January-March 2006 - 2007, thousand tons)

* Source: Rosstat, http://www.lenoblmoloko.ru/stats.9.php

To date, market players as a whole have gone through the stage of formation of the production base and moved on to the stage of building and improving sales mechanisms, including the creation of a strong recognizable brand as the current key factor in the formation of the company's value. Currently, there are about 2,000 dairy producers in Russia. However, 3% of large enterprises cover more than 50% of the Russian dairy market: these are the three world giants Wimm-Bill-Dann, Unimilk and Danone. One of the key elements of the corporate development strategy of large companies is the purchase of regional milk producers. Thus, OJSC Wimm-Bill-Dann Foods (Moscow), a company with more than 1,100 types of products in its assets, continues to develop and expand its area of influence. In November 2006, it acquired a 93.73% stake in OJSC Ochakovsky Dairy Plant (Moscow). This purchase allowed Wimm-Bill-Dann, which already owns three large factories in Moscow, to occupy more than half of the capital's dairy market (based on the article "Overview of the Moscow Dairy Products Market" by the company "Resolution", http://www.foodmarket.spb.ru/archive.php?year=2007&article=1028§ion=4).

According to the experts of the Russian Union of Dairy Industry Enterprises, it is practically impossible for a new player to enter the market, because despite the relatively high profitability of this business, it is too expensive to start it from scratch. Increasing competition and growing pressure from retailers is causing a change in the strategic development priorities of market participants, especially Russian companies. The main tasks of operating enterprises in recent years have been the creation and development of their own brands, expansion of sales geography and promotion of goods in retail trade networks. According to the experts of CVS Consulting, despite all the difficulties, favorable trends have emerged in the dairy market lately. First of all, this is the activation of small dairy enterprises and increased competition in the domestic market, as well as an increase in demand and a change in the style of milk consumption in large cities. The continuation of this trend will allow to increase the market of dairy products by 40% over the next 5-6 years. According to experts of the Russian Union of Dairy Industry Enterprises, the Russian dairy market is still poorly mastered by large Western producers: out of twenty world leaders, only three (Danone, Parmalat and Campina) are represented in our country, while their production volumes in Russia are relatively small. Thus, the Russian market still has a very large potential for domestic producers profiling both sterilized and pasteurized milk. In addition, domestic producers can develop both at the expense of domestic and foreign markets. One of the most promising sales markets is China. According to forecasts, in the next 10-15 years in this country there will be an acute shortage of milk. Already today, demand exceeds the supply of Chinese dairy producers by 30%: from 2001 to 2003. Milk consumption in China has more than doubled, while production has increased by only 70% (based on the article “The Russian dairy market will grow by 40%”, CVS Consulting agency, http://agrofarmexpo.ru/NewsList.do?newsId=192&month=-1&year=-1 and data from DISCOVERY Research Group, http://marketing.rbc.ru/rev_short/31724405.shtml).

The dairy industry is a branch of the food industry that combines enterprises for the production of various dairy products. The industry includes enterprises for the production of animal butter, whole milk products, canned milk, powdered milk, cheese, ice cream, casein and other milk products. In recent years, there has been a decline in milk production in Russia. However, there was some increase in production in 2006, which could be the start of a recovery in this agricultural sector. Thus, already in the first quarter of 2006 gross milk yields were 0.5% higher than in the same period of 2005 (Fig. 1). Such growth is due to the intensification of production, modernization of equipment and the transition to modern technologies for keeping and milking livestock.

Since the beginning of 2007, further growth in milk production has been noted in agricultural enterprises. In January, 1016.4 thousand tons were produced, while the growth, compared to the same period in 2006, amounted to 47.6 thousand tons.* For several years, there has been a sharp decrease in the number of cattle, including cows. However, in recent years, the decline in livestock has somewhat slowed down. In 2006, the volume of the market for milk and dairy products in Russia amounted to $23.1 billion. It should be noted that in monetary terms, traditional dairy products accounted for only 65% of the entire dairy category.**. During the period from mid-2005 to mid-2006, there was a positive dynamics of market growth in value terms, with growth rates of 12%. In general, the Russian dairy market is currently showing steady growth, but its pace has slowed down somewhat. The market growth was caused by the increase in sales of fortified kefir and cottage cheese – by 27% and 25% respectively in value terms. In comparison with 2005, in 2006 the category “drinking yogurt” developed most dynamically on the domestic market – in volume and value terms it grew by 12% and 25%, respectively. The growth of this category was mainly due to the development of the bioproducts segment. Thus, the “drinkable bio-yogurt” segment increased by 23% in real terms. the market has declined somewhat. The analysis of the volumes of Russian production, as well as imports and exports of dairy products, was carried out on the basis of processing customs statistics databases. In domestic practice, the following parameters are traditionally used to characterize the path of goods through customs:

country of origin - the country from which the goods were exported, the place of the last customs clearance;

recipient country - the country where the goods are imported;

shipping company - a company that delivers from the side of the importing country;

recipient company - the company that is the recipient of the goods;

statistical value of the goods - the amount in dollars for which the goods were imported from a particular country or for the reporting period as a whole;

the weight of the imported goods in kilograms.

The total volume of imports of dairy products in 2006 amounted to 396.8 thousand tons in the amount of $ 843 million (Table 1). It should be noted that more than half of the volume of imports, both in kind and in monetary terms, was the import of cheese.

In 2006, the total volume of exports of dairy products in physical and monetary terms amounted to 175.4 thousand tons and $203.6 million, respectively (Table 2). In 2006, about a third of the total export volume, both in kind and in value terms, accounted for the Buttermilk, curdled milk and cream, yogurt, kefir and other products segment. Significant shares belonged to such products as milk and cream, condensed or with added sugar - in physical and value terms, this segment occupied 20.7 and 22.9% of the export of dairy products, respectively. Also, a significant share of exports was occupied by the segment "Whey and other products" - in physical and monetary terms, respectively, 26 and 14.6%.

Despite the decrease in the production of whole milk, the market for dairy products in Russia is growing. First of all, this is due to the expansion of product lines, the emergence of new types and tastes of dairy products, and their enrichment with additional properties. During the period from January to September 2007, the volume of production of whole-milk products amounted to 7.6 million tons.*** Let us consider how the volumes of production of such types of dairy products as butter, cheese and ice cream have changed in recent years. According to experts from the Educational and Experimental Dairy Plant named after Vereshchagin, the production of butter in Russia has been at the level of 270-290 thousand tons per year for several years. At the same time, fluctuations in production volumes are within 3-5%. The growth of the butter market is due to an increase in the supply of imported products. The share of imports in the structure of the Russian butter market is 25–35% of the total supply. Considering the market in the long term, one can note the lack of active dynamics in the development of this segment of the oil and fat industry. In the near future, we can expect further growth in imports while maintaining the volume of domestic production. In 2005, the volume of Russian cheese production increased by 6.4% - from 347.9 to 370.9 thousand tons. While maintaining growth rates, the volume of Russian production of these products in 2006 amounted to about 397 thousand tons. the volume of ice cream production in Russia reached about 405 thousand tons, while the growth rate was 2–2.5%. During the first quarter of 2006, the volume of production of these dairy products increased by 9.7% compared to the corresponding period of 2005 and amounted to approximately 62,000 tons. In 2006, the Northwestern, Central and Far Eastern Federal Districts increased their ice cream production by 186.4%, 128.6% and 102.4% respectively. However, it should be noted that the high growth rates in the first quarter of 2006 in some federal districts are explained by the low rates of the same period in 2005. Among the largest manufacturers represented on the Russian market of dairy products, it is worth noting the following players: OJSC Wimm-Bill-Dann Foods (Moscow, TM Bio Max, Neo, Agusha, Cheerful Milkman, House in the Village) , "Kuban Burenka", "Lamber", "M", "Our Doctor", "Redhead Up", "Miracle"), Unimilk group (TM "Bio Balance", "Doctor Brand", "Summer Day", Petmol, Prostokvashino, Selo Lugovoe, Tyoma, Shadrinskoye) and the Danone group (TM Actimel, Danette, Activia, Danissimo, Rastishka, Skeletons). Wimm-Bill-Dann owns 37 processing plants in Russia, Georgia, Central Asia and Ukraine. Last year, Wimm-Bill-Dann's market share in real terms amounted to 26%. As for the financial performance of this market player, in the first half of 2007 the revenue of the milk division increased by 43.4% compared to the same period in 2006, from $598.4 million to $858.4 million. Unimilk Group includes 29 dairy enterprises in Russia, including Petmol OJSC (St. Petersburg), Milko OJSC (Krasnoyarsk), Samaralakto OJSC (Samara), and two in Ukraine. Unimilk products are sold in Russia, Kazakhstan and Ukraine. The group's market share in 2006 was 15%, while, compared to the previous year, revenue increased to $ 840 million, and sales amounted to more than 1 million tons. The Danone Group, which in 2006 owned 7% of the dairy products market, is represented in Russia by two dairy production plants: in the Moscow region and in the city of Togliatti. In 2006, the company's revenue amounted to $ 561 million. It is worth noting that 90% of sales are accounted for by the brands Activia, Actimel, Danissimo and Rastishka. IMPORT AND EXPORT OF DAIRY PRODUCTS Consider the ratio of imports and exports in different segments of the dairy products market. In 2006, the segments "Butter and other products" and "Cheese" had the largest share of imports (Table 3). In the segment “Milk and cream, not condensed and without added sugar”, the share of imports also prevailed, however, the preponderance in its direction was not so significant. In the segments "Milk and cream, condensed or with added sugar", "Buttermilk, curdled milk and cream, yoghurt, kefir and other products" and "Ice cream containing milk fats", exports of products dominated. In the "Whey and other products" segment, the shares of imports and exports were comparable.

Along with imports and domestic production of dairy products, a separate type of organization of production is observed: the opening of factories of foreign manufacturers in Russia. Thus, according to RBC, in the spring of 2008 Galaktika LLC, a new plant being built on the territory of Gatchina Dairy Plant near St. Petersburg, will start producing sterilized milk and fresh dairy products under the Valio brand. This situation is quite interesting both from the point of view of further development of the domestic market, and from the point of view of creating additional jobs, as well as the influx of foreign investment into the country's economy. Since the early 1990s, Russia has seen a steady decline in the share of domestic dairy production and an increase in the share of imports. Thus, since 2000, the share of imported products has increased from 20 to 40%, and this figure continues to grow. In 2006, import duties on cheese were increased. The decision to increase customs duties on the import of certain types of cheese was aimed at supporting the Russian producer. However, as a result, there was an increase in prices not only for imported cheese - by 20%, but also for Russian products. Until that moment, Russia had a single duty on cheese, which was 15%, but not less than 0.3 euros per kilogram. According to the said decision, the duty on cheeses with a declared statistical value of up to 1.65 euros per kilogram amounted to 0.7 euros. More expensive cheeses worth up to 2 euros per kilogram are subject to a duty of 0.65 euros. For other cheeses, the amount of duty has not changed. Consolidation of companies in the industry can be noted as one of the main trends of recent years. In the coming years, we can predict the strengthening of integration processes in the milk processing market at the regional and federal levels. At the same time, a form that has become widespread is the purchase of controlling stakes in both processing enterprises and agricultural producers of dairy raw materials.***** DAIRY CONSUMPTION Over the past 15 years, milk consumption in the country has declined significantly. If in 1990 consumption was 370 kg per capita - at a rate of 390 kg, now it has dropped to 240 kg. According to a study conducted by CVS Consulting in Moscow as part of the Milk Health project, last year only 33% of Moscow residents bought milk daily. At the same time, 22% of respondents do not buy, and 21% do not drink milk at all. Dairy products are in stable consumer demand. The most popular are yogurt, kefir and cottage cheese - these products are chosen by 38%, 29% and 21% of Muscovites, respectively, who consume fermented milk products daily (Fig. 2).

An analysis of consumer preferences suggests that older people are more likely than young people to buy traditional fermented milk products. The main consumers of these products are people aged 30 to 40 years. Thus, 27% of respondents in this age group drink kefir at least twice a week. Among young people under the age of 20, only 17% use this product 2-4 times a week. Cottage cheese is the least popular among young respondents – no more than 15% of respondents under the age of 30 consume it regularly. Among consumers aged 30 to 40, 60% of Muscovites often eat this type of traditional fermented milk products. MARKET FORECASTS Currently, there is a positive trend in the growth of the dairy products market. In general, the Russian dairy market demonstrates steady growth, but the rate of this growth has somewhat slowed down. In the coming years, the market volume will increase, and, most likely, both due to an increase in the share of Russian production, and due to imports. The domestic market of dairy products is characterized by fierce competition in all segments. According to forecasts, major players will continue their policy of "absorption" of regional producers. An increasing number of consumers prefer pasteurized milk. In addition, in general, the attitude towards milk as a cheap product is changing. In this regard, some manufacturers rely on raising the status of their product, focusing on such characteristics as naturalness, environmental friendliness and high quality. According to the forecasts of the "Company No. 1", in the next ten years, the consumption of traditional fermented milk products, such as kefir, sour cream and cottage cheese, may decrease by 10-15%, while the consumption of yoghurts and dairy desserts, on the contrary, will increase. The most important recent trend in the dairy market is the growing popularity of "live", non-terminated yoghurts with a shorter shelf life. Regarding the range of dairy products, the following trends will be observed in the near future:

increase in the share of branded products;

growth of the product range;

the emergence of non-traditional innovative products;

increase in the share of products with a long shelf life.

As for the packaging of dairy products, according to experts' forecasts, the following trends will be observed:

increase in the share of packaged oil sales;

the emergence and introduction of innovative types of packaging - portion packages, "family" packages, packages with spoons;

growth in the share of portion packaging in the segment of liquid dairy products.

Bibliography

Dairy Union of Russia

Newspaper Kommersant

Magazine "The Secret of the Firm"

Magazine "Expert"

The dairy industry in Russia today is in an extremely difficult situation. The economic and

foreign policy conditions in which the participants work dairy market lead to the accelerated development of negative trends for the dairy industry. The devaluation of the national currency led to an increase in the cost of attracted credit resources, the freezing of investment projects, an increase in the cost, and a decrease in the profitability of milk producers and processors. Participants of the dairy industry, having started in 2014 the process of restoring production efficiency after many years of stagnation (in which the change in state support mechanisms played an important role), were not ready for such a development of the economic situation, as a result of which they were forced to reduce costs, which naturally affected production performance of the industry as a whole. The reduction in the number of cows has led to a decrease in production volumes, and savings on feed and housing conditions (especially in the cold season) will contribute to a decrease in the productivity of the dairy herd.According to the results of 9 months of the current year, the volume of production raw milk decreased by 0.3% compared to the same period last year and amounted to 24,172.9 thousand tons. Agricultural organizations produced 11,331.5 thousand tons of raw milk (or 46.9% of the total), farms) - 1,561.6 thousand tons (6.5%), in households - 11,279.8 thousand tons (46.7%). At the same time, a 2.4% increase in production in agricultural organizations and peasant (private) farms was offset by a 3.3% decrease in production in households, as a result of which the total volume of production decreased. At the same time, the October volumes of raw milk production by all categories of farms turned out to be higher than the corresponding last year ones by 0.6% (2,380 thousand tons against 2,366 thousand tons). But according to the results of 10 months, production volumes still remain below the corresponding last year by

0.1% (26,553 thousand tons vs. 26,577 thousand tons).At the end of 2015, a decrease in raw milk production is expected to 30.4 - 30.5 million tons due to the continued reduction in the number of cows in agricultural organizations and private farms, which will be 1% less than in 2014.

Regionally largest decline in production at the end of 9 months (in relative terms) occurred in Republic of Crimea(-20.4%, up to 172.4 thousand tons), Jewish Autonomous Region(-17.8%, up to 7.8 thousand tons), Kurgan(-14.9%, up to 219.0 thousand tons) and Ulyanovsk(-10.5%, up to 167.6 thousand tons) regions. Maximum relative increase in production in farms of all categories is noted in Kaluga region(+10.8%, up to 193.3 thousand tons), Republic of Ingushetia(+10.5%, up to 55.4 thousand tons) and Kaliningrad region(+10.4%, up to 136.0 thousand tons), as well as in Kirovskaya(+6.8%, up to 438.1 thousand tons), Vologda(+6.6%, up to 357.0 thousand tons), Tula(+5.5%, up to 143.2 thousand tons) areas, Primorsky Territory(+4.8%, up to 99.7 thousand tons), Magadan(+4.0%, up to 4.5 thousand tons), Voronezh(+3.9%, up to 636.7 thousand tons) and Leningrad(+3.6%, up to 441.1 thousand tons) regions.

At the same time, according to the results of 9 months of 2015, 20 constituent entities of the Russian Federation accounted for 63% of the produced volume of milk. The maximum volumes of milk production are maintained in Republic of Bashkortostan(1,412.6 thousand tons, -0.2%), Republic of Tatarstan(1,357.8 thousand tons, +1.3%), Altai(1,123.1 thousand tons, -0.4%) and Krasnodar(1,007.4 thousand tons, +1.5%) regions and Rostov region(844.3 thousand tons, +0.3%). The top 20 milk producers also included Orenburg, Voronezh, Saratov, Omsk, Novosibirsk, Sverdlovsk, Nizhny Novgorod, Moscow, Leningrad, Kirov, Tyumen regions, the republics of Dagestan and Udmurtia, Krasnoyarsk and Stavropol regions.

However, not the entire volume of milk produced is available to processing enterprises. Only the so-called commercial milk. The main volume of commercial milk in the Russian Federation is produced by agricultural organizations, the marketability of milk produced in which (the ratio of the volume of sold milk to the total volume produced) was 94% at the end of 2014 (13.5 million tons of marketable milk were produced). Low marketability in households (about 34%) significantly reduces the volume of raw milk actually available to processors. Agricultural organizations and peasant (farmer) households cannot increase the raw material base in the short term, as a result, there is a shortage of raw milk in the domestic market.

According to the results of 9 months of 2015, the volume of marketable milk production, according to Soyuzmoloko, amounted to about 15.4 million tons, having decreased by 0.3% compared to the same period last year. The structure of production by categories of farms remains the same, however, the share of K (F) H and IP in production is systematically increasing, and the share of households is decreasing. The largest volume of commercial milk is traditionally produced in agricultural organizations (68%, 10.5 million tons). Households of the population, despite the lowest marketability (34%), produced about 25% of marketable milk (3.8 million tons). Peasant (private) farms produced 7% of marketable milk (1.1 million tons) with an average marketability of 69%. One of the reasons for the decline in milk production is the reduction in the number of cows observed over several years, as well as the relatively low milk productivity of cows in households, many C (F) H and old agricultural organizations.

According to the results of 2015, the volume of marketable milk production in farms of all categories, according to preliminary estimates, will remain at the level of 2014, while the decrease in marketable milk production in households will be compensated by an increase in production in agricultural organizations and peasant (farm) farms.

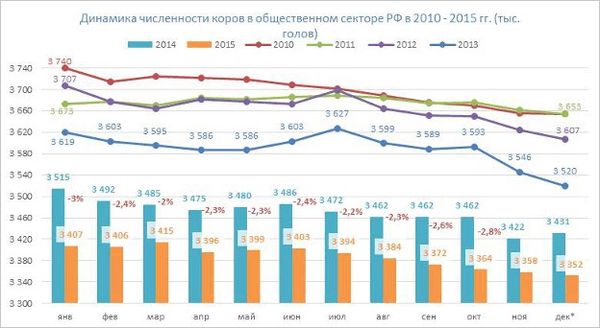

number of cows in general, in the Russian Federation, as of October 1, it decreased by 2.4% (compared to October 01, 2014) and amounted to 8,477.3 thousand heads. A decrease in the number of livestock was noted in farms of all categories, except for K (F) Kh and IP: in agricultural enterprises - by 2.6%, to 3,387.3 thousand heads, in household farms - by 3.5%, to 3,990.5 thousand heads. In K(F)Kh and IP, the livestock increased by 2.5% and amounted to 1,099.5 thousand heads. Such dynamics is explained by the transfer of a certain share of agricultural production from the category of “households of the population” to K (F) KH and IP. At the same time, the increase in milk production in agricultural enterprises is primarily due to the intensification of production. If in 2014, based on the results of 9 months in agricultural organizations, the average milk yield per 1 cow (estimated) was 3,194 kg, then this year this figure increased to 3,259 kg on average in the Russian Federation.

The largest decrease in the number of cows(in relative terms) noted in Kurgan region(-23.8%, up to 57.9 thousand heads), Republic of Kalmykia(-9.2%, up to 351.0 thousand heads) and Smolensk region(-8.8%, up to 50.6 thousand heads). At the same time, in 20 subjects of the Russian Federation, increase in the number of cows. Among them Bryansk(+11.1%, up to 176.4 thousand heads), Kaliningradskaya(+6.1%, up to 49.3 thousand heads) regions and The Republic of Ingushetia(+5.8%, up to 25.9 thousand heads), which showed the largest increase in livestock (in relative terms). The largest number of cows preserved in Republic of Bashkortostan(475.4 thousand heads, -3.0%), Republic of Dagestan(471.9 thousand heads, +1.6%), Altai Territory(382.9 thousand heads, -3.4%) and Republic of Tatarstan(366.9 thousand heads, -1.3%).

The largest decrease in the number of cows(in relative terms) noted in Kurgan region(-23.8%, up to 57.9 thousand heads), Republic of Kalmykia(-9.2%, up to 351.0 thousand heads) and Smolensk region(-8.8%, up to 50.6 thousand heads). At the same time, in 20 subjects of the Russian Federation, increase in the number of cows. Among them Bryansk(+11.1%, up to 176.4 thousand heads), Kaliningradskaya(+6.1%, up to 49.3 thousand heads) regions and The Republic of Ingushetia(+5.8%, up to 25.9 thousand heads), which showed the largest increase in livestock (in relative terms). The largest number of cows preserved in Republic of Bashkortostan(475.4 thousand heads, -3.0%), Republic of Dagestan(471.9 thousand heads, +1.6%), Altai Territory(382.9 thousand heads, -3.4%) and Republic of Tatarstan(366.9 thousand heads, -1.3%).  According to the results of 2015, the number of cows in farms of all categories, according to preliminary estimates, will decrease by 2% and will amount to about 8.3 million heads by the end of the year, - decrease. In the case of agricultural enterprises, the reduction in the number of livestock is explained to a greater extent by the intensification of production and the renewal of the herd for more productive cattle, and the reduction in the number of livestock in household plots is associated with the registration of part of the households in the K (F) Kh, as well as the general trend towards urbanization and the difficult economic situation of the households.

According to the results of 2015, the number of cows in farms of all categories, according to preliminary estimates, will decrease by 2% and will amount to about 8.3 million heads by the end of the year, - decrease. In the case of agricultural enterprises, the reduction in the number of livestock is explained to a greater extent by the intensification of production and the renewal of the herd for more productive cattle, and the reduction in the number of livestock in household plots is associated with the registration of part of the households in the K (F) Kh, as well as the general trend towards urbanization and the difficult economic situation of the households. A systematic increase in the milk productivity of cows in various categories of farms has been observed for several years, while agricultural enterprises demonstrate the highest rates. During the period from 2009 to 2014, the average productivity of cows in agricultural enterprises increased by 18%, up to 4,841 kg/year, while there is no intensification of production in the households of the population. On average in the Russian Federation (farms of all categories) over the same period, the growth was 8%, from 3,737 to 4,021 kg/year. However, the difficult economic situation of most agricultural producers does not allow for the modernization and intensification of production at the present time. The increase in the cost of feed, repair and maintenance of imported equipment against the backdrop of rising costs and unavailability of credit funds lead to the need to reduce production costs by all available means. As a result, the quality of feed is reduced, the conditions for keeping animals are deteriorating, and the milk productivity of cows is falling.

According to the results of 2015, the increase in the average milk productivity of 1 cow (for all categories of farms), according to preliminary estimates, will continue, but the pace will slow down, as a result, milk production from one cow may average 4,100 kg/year.

According to the results of 2015, milk production volumes will most likely be slightly lower than in 2014 (about 30.4 - 30.5 million tons). Next year, the trends of the current year (production stagnation, reduction in the number of cows, a decrease in milk production in households and an increase in peasant (farm) households and agricultural organizations) will most likely continue, which will lead to a further decrease in production in the absence of additional support from the side of the state.According to the estimates of the Ministry of Economic Development, presented in the draft Forecast of the socio-economic development of the Russian Federation for 2016 and for the planned period of 2017 and 2018, next year there will be a positive trend towards the recovery of the industry. In this case, the increase in the production of raw milk in 2016 may be about 0.3%, in 2017 - 0.6%, in 2018 - 0.7%. Raw milk production growth in 2018 compared to 2014 will be 1.7%. In absolute terms, production in 2018 may amount to about 31.3 million tons. This will be facilitated by the resumption of growth in the Russian economy, the systematic strengthening of the ruble, and the expected decrease in annual inflation from 12.2% in 2015 to 6.4%, according to the Ministry of Economic Development. % in 2016, an increase in the capacity utilization of processing enterprises, a reduction in the share of imports of milk and dairy products in the commodity resources of the domestic market, and an increase in the purchasing power of the population's money income.

At the same time, according to Soyuzmoloko, the forecast for the development of dairy cattle breeding for 2016 is unlikely to look so optimistic. The increase in milk production in agricultural enterprises, K (F) Kh and IP in recent years is associated with a number of factors, the influence of which will cease in 2016.

In 2013-2014, the price of raw milk increased significantly. If in January 2013 the average price in the Russian Federation was about 15.4 rubles/kg, then in January 2015 it rose to 21.1 rubles/kg (+37%), which allowed agricultural organizations to increase the intensity of production. As a result, the average productivity of cows in agricultural enterprises increased to 4,841 kg/year, in K(F)X - up to 3,450 kg/year. At the same time, grants to support start-up farmers contributed to the transition of households to the status of peasant (farmer) households, which also contributed to the improvement of their financial condition and production efficiency. At the same time, the rate of decrease in the number of cows turned out to be lower than the rate of growth in the milk productivity of animals in agricultural organizations. The combination of these factors made it possible not to reduce milk production at the end of 2014 (there is even an increase in production by 1%).

However, a significant increase in production costs in late 2014 - early 2015 due to the devaluation of the national currency, not supported by an increase in purchase prices for milk, the “freezing” of existing and the absence of new investment projects in the field of dairy cattle breeding led to a decrease in the profitability of milk production and processing, in As a result, agricultural producers were forced to look for ways to reduce the cost of their product. Most likely, this will also lead to a decrease in the productivity of cows in 2015 and 2016, which will be the reason for the decrease in gross milk yield.

In 2016, according to Soyuzmoloko, according to the optimistic scenario for the development of the industry (if there is an influence of positive factors noted by the Ministry of Economic Development), milk production in households will decrease by 3-5%, which will amount to about 600 thousand tons of C (F) X and IP will show an increase at the level of 4-5% (about 90 thousand tons), and production in agricultural organizations will most likely remain at the level of 2014-2015. Thus, according to the results of 2016, milk production in farms of all categories will be about 30.1 - 30.2 million tons, which is 1.6% lower than the predicted results of 2015. Under a conservative scenario (a decrease in the volume of state support funds, the continuation of existing trends and the cost of production), a decrease in production should also be expected in agricultural enterprises at the level of 2%. As a result, the volume of milk production in farms of all categories will decrease more significantly in 2016 and can overcome the psychological barrier of 30 million tons.

2. Production of dairy products

The introduction of special economic measures in August 2014 made it possible to exempt up to 20% of the Russian dairy market from imported products, and domestic producers successfully began to fill the resulting niche, increasing production volumes (this applies primarily to cheese and butter). In 2016, we should expect an increase in the production and sale of dairy products. According to the Ministry of Economic Development, the increase in sales of dairy products in 2016 will be 1%, in 2017 - another 2.4%, in 2018 - 2.6%. As a result, sales of dairy products in 2018 will increase by 6.1% compared to 2015.The largest increase in production was noted for cheeses and cheese products. According to the results of 10 months of 2015, the production of cheeses and cheese products amounted to 490 thousand tons, exceeding the corresponding figure of the previous year by 21.6%, including cheese - 381 thousand tons (+22%), cheese products - 109 thousand tons (+21%). In the structure of production of cheeses and cheese products by types, hard cheeses (25%) traditionally occupy the largest share, followed by cheese products (22%), semi-hard cheeses (20%), processed cheeses (18%) and other types of cheeses.

In addition to cheeses and cheese products, an increase in production was also noted for butter (by 4.2%, up to 222.5 thousand tons in the first 10 months of 2015) and whole milk products in terms of milk (by 1.0%, up to 9. 7 million tons).

At the end of the year, the trend of increasing production volumes relative to the level of 2014 is expected to continue. As a result, the production of whole-milk products can reach about 11.6 million tons, cheese - 455 thousand tons, cheese products - 135 thousand tons, butter - 260 thousand tons.

At the same time, today there are restrictions for increasing the production of dairy products and import substitution. In the context of devaluation of the national currency, the cost of production and processing of milk has increased significantly. As a result, domestic milk production continues to stagnate. The reasons are the underdevelopment of the raw material base, which cannot be increased in a short time, the low profitability of milk production and processing, the relatively low investment attractiveness of dairy cattle breeding due to the long payback period (about 15 years under current conditions) and the high share of inefficient households in milk production. As a result, net imports of milk and dairy products may amount to about 7.1 million tons (in terms of milk) by the end of 2015, the volume of imports of palm oil is increasing, and the production of counterfeit products is growing. An increase in the share of falsified products on the market reduces the profitability of dairy processing enterprises, does not allow modernizing production and increasing its efficiency.In addition, the increase in retail prices for dairy products (which is a deferred effect from the increase in prices for raw milk at the end of 2013-2014) and the decrease in the purchasing power of the population's money income lead to a reduction in consumer demand for high-quality finished products, which also leads to a decrease in purchase prices for raw milk and lower business profitability.

According to preliminary calculations by Soyuzmoloko and the MilkNews Analytical Center, based on an analysis of the estimated balance of milk fat for 9 months of 2015, the deficit of milk fat for dairy products is 9-10%, in 2014 (for 9 months) this figure did not exceed 5%. That is, in 2015, about 10% of dairy products produced are falsified (milk fat is replaced by fats of vegetable origin), but how this volume is distributed among certain types of dairy products, one can only guess. Most likely, these are milk-intensive products with high added value and in demand among the population - cheeses, butter.

Taking into account the dynamics of the volumes of Russian production of individual dairy products, it is most likely that these volumes should be attributed to a greater extent to cheeses, the production of which increased by 25% over 9 months (at the same time, the production of whey as a by-product of cheese making increased over the same period only by 16%). Butter production increased by only 5%. Moreover, according to preliminary estimates of Soyuzmoloko, the substituted vegetable fats the volume of milk is about 2.0 - 2.3 million tons, which is equivalent to the expected decrease in the volume of imports of milk and dairy products at the end of the year.

Comment: more detailed information on production volumes and stocks of dairy products is provided in the monthly Soyuzmoloko reports "Milk and dairy products: production and stocks", available for download in the "Analytics" section of the official website of the National Union of Milk Producers Soyuzmoloko www.souzmoloko.ru

3. Import and export of dairy products

During the period from 1990 to 2014, imports of milk and dairy products to the Russian Federation increased from 8.0 to 9.2 million tons, while due to a decrease in domestic milk production, the share of imports in the resources of the domestic dairy market (reserves, own production and imports ) increased over the same period by almost 2 times: from 12% to 22%. However, when compared with the volume of marketable milk production, which at the end of 2014 amounted to 19.7 thousand tons in farms of all categories, the share of imports in resources increases to 30%.The introduction since August 2014 of special economic measures against a number of countries that supplied agricultural products, including dairy products to the Russian Federation, contributed to a significant reduction in import supplies of dairy products to Russia. During the period from September to December 2014, the volume of import supplies of dairy products (in terms of milk) decreased by 28.4%, to 2,502 thousand tons. At the same time, countries that previously provided up to 36% (2013) left the Russian market. all imports. Among them: Finland (butter and cheeses), the Netherlands (cheeses), Germany (cheeses and cheese-like products), Lithuania (cheeses), Poland (cheeses), France (butter, cheese, whey) and other countries.

According to the Federal Customs Service of Russia, the total import of milk and dairy products decreased by 27% in the first 10 months of this year (to 5,338 thousand tons in terms of milk for a total of USD 1,532 million), from the so-called “non-sanctioned” countries remains higher by about 4%, that is, a certain volume of imports has been “replaced” not by domestic production, but by imports from other countries.

According to the Federal Customs Service of Russia, the total import of milk and dairy products decreased by 27% in the first 10 months of this year (to 5,338 thousand tons in terms of milk for a total of USD 1,532 million), from the so-called “non-sanctioned” countries remains higher by about 4%, that is, a certain volume of imports has been “replaced” not by domestic production, but by imports from other countries.According to the results of the current year, the share of imports in the commodity resources of the domestic market of milk and dairy products is expected to decrease to 15 - 18% (and when assessed for marketable milk - up to 25%), as a result, the volume of imports will be about 7.0 - 7.1 million tons. It should also be noted that in 2015, a small volume of imports of dairy products from countries that fell under the "sanctions" remained. This is due to the supply of “specialized” products intended for dietary therapeutic and dietary preventive nutrition (the import of which is allowed), as well as the supply of cheese-like products in the first half of this year before the Decree of the Government of the Russian Federation dated June 25, 2015 No. 625 enters into force, in accordance with which changes are made to the list of products prohibited for import into Russia (including the import of cheese-like products under the TN VED code 1901909900).

The regional structure of import supplies of dairy products after the introduction of special economic measures in August 2014 has changed significantly, however, the Republic of Belarus remains the main country that supplies dairy products to the territory of the Russian Federation, from which about 42% of all dairy products were imported in 2013, in 2014 - 52%, for 10 months of the current year - about 85%. In addition to Belarus, dairy products are supplied to the Russian market today by Uruguay (about 3%, mainly butter), Argentina (about 3%, butter, Cheddar, Gouda and other cheeses, SOM, whey powder), New Zealand (2%, butter ) and Kazakhstan (less than 1%, condensed milk and cream or with added sugar).

The regional structure of import supplies of dairy products after the introduction of special economic measures in August 2014 has changed significantly, however, the Republic of Belarus remains the main country that supplies dairy products to the territory of the Russian Federation, from which about 42% of all dairy products were imported in 2013, in 2014 - 52%, for 10 months of the current year - about 85%. In addition to Belarus, dairy products are supplied to the Russian market today by Uruguay (about 3%, mainly butter), Argentina (about 3%, butter, Cheddar, Gouda and other cheeses, SOM, whey powder), New Zealand (2%, butter ) and Kazakhstan (less than 1%, condensed milk and cream or with added sugar).  The main dairy products imported into Russia are still cheeses and cottage cheese (about 35% of all imports for the first 10 months of this year in value terms, including cheese - about 29%, young cheeses and cottage cheese - 6%), condensed milk and cream (22%), including powdered milk, butter (about 16%), whole milk products (9%) and cheese (cheese-like) products (7%). At the same time, the share of milk-intensive products (cheeses and butter) in the total volume of imports tends to decrease, which has a positive effect on Russian butter and cheese producers and is mainly due to an increase in the volumes of domestic production of these products. At the same time, the share of cheese products, milk powder, whole milk and fermented milk products (mainly from the Republic of Belarus) is growing.

The main dairy products imported into Russia are still cheeses and cottage cheese (about 35% of all imports for the first 10 months of this year in value terms, including cheese - about 29%, young cheeses and cottage cheese - 6%), condensed milk and cream (22%), including powdered milk, butter (about 16%), whole milk products (9%) and cheese (cheese-like) products (7%). At the same time, the share of milk-intensive products (cheeses and butter) in the total volume of imports tends to decrease, which has a positive effect on Russian butter and cheese producers and is mainly due to an increase in the volumes of domestic production of these products. At the same time, the share of cheese products, milk powder, whole milk and fermented milk products (mainly from the Republic of Belarus) is growing.This situation is a consequence of the change in the structure of consumer demand in the context of a reduction in the monetary income of the population in 2014 and 2015. Consumers have shifted to cheaper dairy products with low added value, reducing their consumption of cheese and butter. In addition, the increase in the share of counterfeit products in the Russian dairy market contributes to a decrease in consumption.

In January-October of the current year, the total volume of imports of palm oil, used in processing industries as a substitute for milk fat, in physical volume amounted to 702.1 thousand tons (+25.1% compared to the same period in 2014), in value terms - USD 520.0 million (-0.5% compared to 2014). Thus, in comparison with last year, cheaper palm oil is imported to Russia: if in 2014 the average (estimated) price of 1 ton of palm oil imported to the Russian Federation was 930.1 USD, then this year it is 740.1 USD (-20 ,four%). This is due to a general decline in world prices for palm oil in June - August of this year due to an increase in production volumes in the main producing countries - Indonesia and Malaysia.

In January-October of the current year, the total volume of imports of palm oil, used in processing industries as a substitute for milk fat, in physical volume amounted to 702.1 thousand tons (+25.1% compared to the same period in 2014), in value terms - USD 520.0 million (-0.5% compared to 2014). Thus, in comparison with last year, cheaper palm oil is imported to Russia: if in 2014 the average (estimated) price of 1 ton of palm oil imported to the Russian Federation was 930.1 USD, then this year it is 740.1 USD (-20 ,four%). This is due to a general decline in world prices for palm oil in June - August of this year due to an increase in production volumes in the main producing countries - Indonesia and Malaysia.Export of dairy products from Russia remains relatively small and focused mainly on Kazakhstan and other countries of the former CIS. During the period from January to October 2015, 519 thousand tons of dairy products were exported from Russia in terms of milk (-14% compared to the same period in 2014) for a total amount of 204 million USD. At the end of 2015, the volume of exports of milk and dairy products (in terms of milk) may reach 618 thousand tons in the amount of 278 million USD.

The structure of exports by types of dairy products has remained stable for several years. According to the results of 10 months of the current year, the largest share in exports (in value terms) falls on fermented milk products (about 29% - 30%), cheeses and cottage cheese (21%) are in second place, followed by ice cream (14%), condensed milk and cream (13%), whole milk products (10%) and cheese products (7%).

The structure of exports by types of dairy products has remained stable for several years. According to the results of 10 months of the current year, the largest share in exports (in value terms) falls on fermented milk products (about 29% - 30%), cheeses and cottage cheese (21%) are in second place, followed by ice cream (14%), condensed milk and cream (13%), whole milk products (10%) and cheese products (7%).  Comment: more detailed information on the volume of foreign trade of the Russian Federation in dairy products is presented in Souzmoloko's monthly reports "Foreign Trade of the Russian Federation in Dairy Products", available for download in the "Analytics" section of the official website of the National Union of Milk Producers Souzmoloko www.souzmoloko.ru

Comment: more detailed information on the volume of foreign trade of the Russian Federation in dairy products is presented in Souzmoloko's monthly reports "Foreign Trade of the Russian Federation in Dairy Products", available for download in the "Analytics" section of the official website of the National Union of Milk Producers Souzmoloko www.souzmoloko.ru4. Price situation in the market of milk and dairy products

The price conjuncture of the dairy market is determined by fundamental and market factors. Existing trends in the industry contribute to a systematic increase in prices. However, raw milk prices are subject to high volatility depending on the time of year. Processors are faced with the problem of excess raw materials in the summer months (the “big milk” season) and shortages in the winter, which is reflected in the level of purchase prices.According to the Federal State Statistics Service (Rosstat), in November the average the price of agricultural producers for raw milk increased by 3.8% compared to October and amounted to 21.1 rubles/kg. In 2014, the average price level for raw milk in November was 20.1 rubles/kg, which is 4.6% lower than the current level.

An increase in the level of prices for raw milk in the autumn-winter period is traditional and is explained by the increasing costs of agricultural producers for feed, heat and electricity in the cold season, as well as a decrease in animal productivity. The price difference with the level of the previous year is also understandable: inflationary processes, exacerbated by the devaluation of the national currency and an increase in the cost of repair and maintenance of imported equipment, led to a significant increase in the cost of milk produced in 2014-2015, while many agricultural producers are on the verge of profitability or are unprofitable , and the unavailability of credit resources (both short-term and investment) due to high interest rates does not allow for the modernization of production and cost optimization.

An increase in the level of prices for raw milk in the autumn-winter period is traditional and is explained by the increasing costs of agricultural producers for feed, heat and electricity in the cold season, as well as a decrease in animal productivity. The price difference with the level of the previous year is also understandable: inflationary processes, exacerbated by the devaluation of the national currency and an increase in the cost of repair and maintenance of imported equipment, led to a significant increase in the cost of milk produced in 2014-2015, while many agricultural producers are on the verge of profitability or are unprofitable , and the unavailability of credit resources (both short-term and investment) due to high interest rates does not allow for the modernization of production and cost optimization.Medium industrial producers price on the 2.5-3.2% fat content was established at the level of 34.5 rubles/kg without significant changes over the month, by butter- 249.0 rubles/kg (+1.9%), on hard cheeses- 283.3 rubles/kg (-4.6%).

Medium consumer price on the pasteurized drinking milk 2.5-3.2% fat amounted to 47.1 rubles/kg (+0.9% per month), butter- 394.4 rubles/kg (+1.1%), on rennet cheeses, hard and soft- 415.7 rubles/kg (+1.2%).

Until the end of the year, prices for raw milk may rise to 21.5 - 22.0 rubles/kg, which will be higher than last year's level (in December 2014, the average price for raw milk was 20.8 rubles/kg). In the 1st quarter of 2016, price increases will also continue under the influence of the seasonal factor and devaluation risks, however, the growth rate of prices for raw milk will weaken due to a decrease in consumer demand for dairy products and high price competition with Belarusian exporters of dairy products to Russia.

The increase in prices in the processing and retail segment is currently a delayed effect of the increase in prices for raw milk in 2013-2014, caused by an attempt by agricultural producers to ensure the level of profitability necessary for the modernization of production (which was never achieved) in the face of a continuing shortage of raw milk and expansion of imports of dairy products. Thus, from August 2013 to August 2015, the increase in prices for raw milk amounted to 28.5%. Over the same period, the prices of industrial producers for whole pasteurized milk increased by 31.5%, retail prices for whole pasteurized milk 2.5 - 3.2% fat. - by 31.4%. At the same time, producer prices for hard cheeses increased by 32.8%, for cheese products - by 49.5%, retail prices for cheeses - by an average of 38.8%. The situation is similar with butter. From August 2013 to August 2015 retail prices for butter increased by an average of 38.9%, while producer prices increased by 30.3%.

World prices in the dairy market are influenced by the volumes of production, consumption and foreign trade of the main participants in the world dairy market - the USA, EU countries, New Zealand, Australia, Argentina, Brazil, China and other countries.

World prices in the dairy market are influenced by the volumes of production, consumption and foreign trade of the main participants in the world dairy market - the USA, EU countries, New Zealand, Australia, Argentina, Brazil, China and other countries.In December, prices for dairy products continued to rise, which began in the second half of November, but at a slower pace, while sales volumes continue to decline. As a result of trades that ended on 12/15/2015 on the specialized trading platform GlobalDairyTrade (GDT), the average world price index for dairy products strengthened by 1.9% compared to 01/12/2015 trading. The weighted average indicative price for dairy products amounted to 2,458 USD/t, remaining 5.8% lower than the level of the corresponding period last year (2,609 USD/t). In total, 24.9 thousand tons of dairy products were sold at the auction, which is 11.6% less than in previous auctions (-29.7% compared to last year).

The increase in the weighted average price was facilitated by the continued strengthening of prices for butter (price index amounted to +9.0%, up to 3,136 USD/t), powdered whole milk (+1.8%, up to 2,304 USD/t), as well as anhydrous milk fat (+6.1%, up to 3,721 USD/t), lactose (+6.8%, up to 542 USD/t), Cheddar cheese (+1.1%, up to 2,856 USD/t). At the same time, prices for dry buttermilk (-6.1%, to 1,564 USD/t) and rennet casein (-9.5%, to 4,541 USD/t) continued to decline. The average price for skimmed milk powder at the end of the auction amounted to 1,891 USD / t, which is 1.4% less than the level of the previous auction.

Bidding is held twice a month, the next auction will be held on January 5, 2016.

Belarus, being the main external supplier of dairy products to the Russian market, creates serious price competition for domestic producers on the domestic market of the Russian Federation. The minimum recommended export prices of the Republic of Belarus for certain types of dairy products (entered into force on November 21, 2015) are:

for skimmed milk powder- 160 rubles/kg (previously the tariff was 155 rubles/kg),

dry whole milk- 185 rubles/kg (previously - 175 rubles/kg),

butter 82.5% fat- 220 rubles/kg (previously - 215 rubles/kg),

butter 72.5% fat- 195 rubles/kg (no change),

cheeses and cheese products with a fat content of 45% or less- 240 rubles/kg (no change),

cheeses and cheese products with a fat content above 45%- 245 rubles/kg (no change).Comment: a more detailed overview of the price situation in the dairy market is presented in Soyuzmoloko weekly reports “Overview of the price situation in the milk and dairy products market”, available for download in the “Analytics” section of the official website of the National Union of Milk Producers Soyuzmoloko www.souzmoloko.ru

5. State support for the dairy industry

In accordance with the State Program for the Development of Agriculture and the Regulation of Agricultural Products, Raw Materials and Food Markets for 2013-2020 (as amended by Decree of the Government of the Russian Federation of December 19, 2014 N 1421), state support for the dairy industry of the Russian Federation is carried out in 2015 in the form of subsidies raw milk producers in the following key areas:- subsidies for 1 kilogram of milk sold and (or) shipped for own processing;

- reimbursement of part of the interest rate on investment loans (loans) for the construction and reconstruction of dairy cattle breeding facilities (the direction is allocated as a separate type of support in accordance with the provisions of the draft Dairy Industry Development Program until 2020, developed by Soyuzmoloko in 2014);

- reimbursement of part of the interest rate on short-term loans (loans) for the development of dairy cattle breeding (the direction is allocated as a separate type of support in accordance with the provisions of the draft Program for the Development of the Dairy Industry until 2020, developed by Soyuzmoloko in 2014);

- subsidies for reimbursement of part of the direct costs incurred for the creation and modernization of dairy livestock complexes (dairy farms) (the direction was introduced in accordance with the provisions of the draft Program for the Development of the Dairy Industry until 2020, developed by Soyuzmoloko in 2014).

In the indicated areas of support in 2015, as of December 10, 2015, the allocation of RUB 23.2 billion(excluding funds from the budgets of the constituent entities of the Russian Federation in the direction of support "Reimbursement of part of the direct costs incurred for the creation and modernization of dairy farming facilities", the distribution of which has not yet been approved by the Government of the Russian Federation), including at the expense of the federal budget on the terms of co-financing from the budgets of the constituent entities of the Russian Federation - RUB 13.5 billion (or 58%), from the budgets of the constituent entities of the Russian Federation - 9.7 billion rubles. (or 42%).

As of December 10, 2015, 18.75 billion rubles were brought to agricultural producers. (80.1%) from funds to support dairy cattle breeding, including from the federal budget - 10.08 billion rubles. (level of development - 74.5%) from the budgets of the subjects of the Russian Federation - 8.67 billion rubles. (89.5%). At the same time, subsidies “per 1 kg of marketable milk” have been brought to a greater extent (95.1% of the provided funds have been disbursed), and funds allocated to support lending have been brought to a lesser extent: about 44.7% of funds were brought on investment loans, and 46% on short-term loans. .3%.

In the structure of state support in areas from the budgets of all levels, the largest share falls on subsidizing the production of commercial milk (73% or 16.9 billion rubles in 2015) and subsidizing part of the interest rate on investment loans (24% or 5.6 billion rubles . in 2015).

In addition to these areas of support, milk producers have the opportunity to receive state support in other areas (providing unrelated support in the field of crop production, support for small forms of farming - family livestock farms, start-up farmers, grant support for agricultural consumer cooperatives for the development of material and technical base, and others). In addition, in most constituent entities of the Russian Federation there are local areas of support for agricultural producers (including milk producers), financed exclusively from the budgets of the constituent entities of the Russian Federation.

In accordance with the President of the Russian Federation V. Putin signed on December 14, 2015 federal law No. 359-FZ "On the federal budget for 2016", to support the dairy industry in the budget for 2016, 29.2 billion rubles (12.5% of the total funds allocated under the State Program for the Development of Agriculture and Regulation of Agricultural Products, Raw Materials and Food Markets for 2013-2020), including within the framework of the subprogram "Development of Dairy Cattle Breeding" - 26.6 billion rubles, within the framework of the subprogram "Support of breeding business, breeding and seed production" - 2.6 billion rubles. In total, 233.0 billion rubles are allocated to support agriculture within the framework of this state program next year, including Ministry of Agriculture of Russia 213.1 billion rubles will be allocated, Ministry of Culture of Russia- 0.3 billion rubles, Rosselkhoznadzor- 12.0 billion rubles, Federal Highway Agency- 7.6 billion rubles.

The extension of the food embargo, growing inflation and devaluation of the national currency, the development of an import substitution program, attempts to combat counterfeiting - these are the main things that I remember in the past year.

As a result of the depreciation of the national currency and the action of counter-sanctions, imports of dairy products fell sharply, and the resulting gap was filled at the expense of three main sources. First, as will be shown below, the production of raw milk in the corporate sector has increased. Secondly, imports of dry dairy products increased sharply, with Belarus becoming the dominant supplier. And thirdly, many companies have resorted to a tried and true solution to the problem of cheap milk fat substitutes: imports of palm oil have increased significantly.

According to the results of 10 months of 2015, the volume of imports of butter decreased by 38.5% compared to the same period last year (from 125 thousand tons to 77 thousand tons). Imports of cheese and cheese products for the period January-October 2015 decreased by 43% and amounted to 142 thousand tons (against 249 thousand tons in the same period in 2014). The situation on the market of dry dairy products is as follows: the volume of imports for 10 months increased by 45% compared to the previous year, from 162 thousand tons to 236 thousand tons, with 97% of all dry dairy products imported from Belarus.

Domestic production reacted with modest growth. Thus, the volume of production of butter increased by 3%. 1% - whole milk products in terms of milk. The volume of production of dry dairy products, on the contrary, decreased by 4%.

Separately, it should be said about the production of cheeses and cheese products. At the end of the year, the production volume amounted to 580 thousand tons, having exceeded the indicator of a year ago by 20%. The question arises why there is such a positive trend, given that there is still a shortage of raw milk in Russia. It is worth mentioning that the volume of imports of palm oil in the first 10 months of 2015, according to Rosstat, increased by 25%. The purchasing power of the population is falling, manufacturers are forced to use cheap raw materials to reduce costs. The share of adulteration in the total volume of dairy products continues to grow at an alarming rate. It is often impossible for buyers to determine what is on the shelf - real cheese or its "analogue".

In general, the average monthly volume of the butter market (the total number of butter produced and imported into the Russian Federation minus exports), according to IKAR, will decrease from 34 to 30 thousand tons at the end of the year. The capacity of the cheese market will be reduced from 64 to 62 thousand tons. The market capacity of dry dairy products will increase from 37 to 44 thousand tons. The market capacity of whole milk products will increase from 989 to 993 thousand tons.

In the development of the commodity sector, the trends laid down in previous years continued. The number of cows in the agricultural sector continues to slowly decrease, but due to the increase in productivity, the production of raw milk in the agricultural sector is increasing. Thus, at the end of the year, the number of livestock will be 3.35 million heads, which is 2.2% less than in 2014. However, it should be taken into account that, in fact, in this population, meat and local cattle were also counted, the number of cows in which is estimated at up to 1 million heads. Thus, the actual number of cows of the dairy herd in agricultural organizations is no more than 2.5 million heads.

Thanks to structural changes aimed at improving technological processes and optimizing the breed composition of animals, as well as the emergence of new modern projects in the dairy industry, the productivity of the dairy herd in agricultural organizations improved in 2015, demonstrating good growth rates (average milk yield per 1 cow increased by 24 kg or 5.5% compared to last year's figures).

For the second year in a row, there has been a clear and steady upward trend in milk production in the sector of agricultural organizations. According to the results of 11 months of 2015, agricultural enterprises produced 13.5 million tons of milk, which is 2.2% more than the same period last year.

In 2015, shipments of raw milk for industrial processing increased: 13.85 million tons were shipped, which is 3.2 percent higher than a year ago.

The average purchase prices for milk 1/s and s/s in the Russian Federation in 2015 amounted to 20.83 rubles/kg and 22.88 rubles/kg, respectively. For comparison, a year ago they were 20.59 and 22.97 rubles/kg. Prices traditionally rise towards the end of the year, which is explained by the seasonality of production and the increase in production costs.

Dairy production in Russia continues to be in a very difficult position. It is quite difficult to talk about development prospects. The devaluation of the ruble leads to a decrease in the purchasing power of the population, a drop in demand, a reduction in attracted investments, and an increase in interest rates on loans for milk producers. Rising foreign exchange rates increase costs due to the fact that equipment, veterinary preparations, feed additives, etc. are of foreign origin. The dairy sector needs clear technical standards - the consumer should have the right to receive reliable information about the quality parameters of the product. In 2016, 29 billion rubles will be allocated to support the industry, which will be 12.5% of the state program for the development of agriculture for 2013-2020. It is possible to carry out public procurement interventions in the markets for dairy products. Time will tell if the situation changes for the better.

Commodity science and expertise of flavoring goods: Textbook / Ed. I.P. Chepurnaya. - M., 2006.

Frenkel A.A. Economy of Russia 2006 - 2008. - M .: Finstatprom